Los Angeles Credit Card Debt Lawyers

Effective Credit Card Debt Relief Services in California

Everyone is struggling with the high interest rates of our once beloved credit cards, and it can be hard to find solutions and get back on the right track to financial solutions. An experienced bankruptcy lawyer in Los Angeles can help you evaluate your options and consolidate your credit card debt. You could even find a way to get debt relief while you avoid bankruptcy.

At the law offices of RHM LAW LLP, serving clients in San Fernando Valley and throughout Los Angeles, Riverside, San Bernardino, and Orange Counties, we help our Southern California clients consolidate their debt and get immediate relief through bankruptcy. You do not have to go through this difficult process on your own. We can help you find solutions to your credit card debt.

Contact our firm by calling (213) 344-0043 today for a 30-minute complimentary consultation. It could be your first step out of the dark and into the light.

Possible Options to Eliminate Credit Card Debt

You can use either Chapter 7 bankruptcy or Chapter 13 bankruptcy to eliminate your credit card debt.

Our attorneys can help you explore your options and find the financial solutions that work for you:

Chapter 7 Bankruptcy for Consumers: If you qualify for Chapter 7 bankruptcy, you will get to eliminate all of your dischargeable debt immediately, including credit card debt.

Chapter 13 Bankruptcy: By creating a payment plan you can afford, you can make timely payments on your credit card debt over a three-to-five-year period until it is finished.

While bankruptcy provides many excellent options, it is not right for everyone. We also help clients explore other options for paying off their credit card debt, such as loan modifications.

When to Work with a Credit Card Debt Attorney in Los Angeles

Facing mounting credit card debt can be overwhelming, leading many individuals to seek professional guidance. While managing debt independently is feasible for some, there are scenarios where hiring a credit card debt attorney becomes not just beneficial but imperative. Understanding when to enlist their expertise can significantly impact one's financial well-being.

- Complex Legal Proceedings: Navigating the legal intricacies of credit card debt can be daunting. When creditors escalate the matter to court or file a lawsuit against you, seeking legal representation becomes crucial. A credit card debt attorney possesses the expertise to handle legal proceedings adeptly, ensuring your rights are protected throughout the process.

- Negotiating Debt Settlements: Engaging in negotiations with creditors to settle outstanding debts requires finesse and legal know-how. A seasoned credit card debt attorney can skillfully negotiate on your behalf, aiming to secure favorable terms such as reduced settlements or extended payment plans. Their negotiation prowess can potentially save you a significant amount of money and alleviate the burden of unmanageable debt.

- Defense Against Creditor Harassment: Experiencing relentless harassment from creditors and debt collectors is not only distressing but also illegal. A credit card debt attorney can intervene, putting an end to harassing phone calls, letters, or threats. They have the legal authority to communicate with creditors on your behalf, providing a shield against abusive collection tactics.

- Asset Protection Strategies: In cases where creditors pursue aggressive collection actions, safeguarding your assets becomes paramount. A credit card debt attorney can employ various legal strategies to protect your property, wages, and other assets from seizure or garnishment. By leveraging their knowledge of debtor protection laws, they can help you preserve your financial resources and maintain stability amidst debt-related challenges.

- Comprehensive Legal Counsel for Your Financial Health: Beyond addressing immediate debt-related issues, a credit card debt attorney offers comprehensive legal counsel tailored to your financial situation. They can assess your overall financial health, provide personalized advice on debt management and bankruptcy options, and devise a strategic plan to achieve long-term financial stability.

Why Choose RHM LAW LLP for Your Bankruptcy Needs

Providing a casual and accepting environment from our San Fernando Valley and Los Angeles offices, our attorneys offer big firm experience in a smaller firm setting. Open Monday through Friday, we offer 30-minute complimentary consultations from 7 a.m. to 7 p.m., as well as weekend appointments. Long-term payment plans are available to help you through this difficult time.

Our Los Angeles bankruptcy attorneys can give you the tools you need to succeed. Contact us at (213) 344-0043 to get started.

RHM LAW LLP

Meet Our Los Angeles Bankruptcy Specialists

-

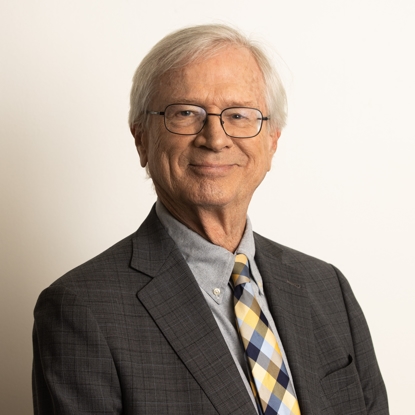

M. Jonathan Hayes Senior Counsel

M. Jonathan Hayes Senior Counsel -

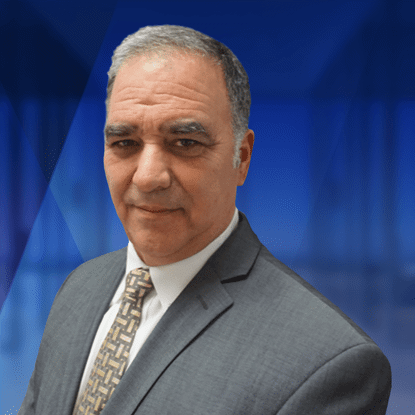

Matt D. Resnik | Partner Partner

Matt D. Resnik | Partner Partner -

Roksana D. Moradi-Brovia | Partner Partner

Roksana D. Moradi-Brovia | Partner Partner -

Russell J. Stong III | Associate Attorney Senior Associate Attorney, Los Angeles Office

Russell J. Stong III | Associate Attorney Senior Associate Attorney, Los Angeles Office -

W. Sloan Youkstetter | Associate Attorney Senior Associate Attorney, Los Angeles Office

W. Sloan Youkstetter | Associate Attorney Senior Associate Attorney, Los Angeles Office -

David M. Kritzer Senior Associate Attorney, Encino Office

David M. Kritzer Senior Associate Attorney, Encino Office

Client Reviews

What Clients Say About Working With Us

-

"These are top-notch pros that'll have your back. I cannot recommend them highly enough."Where to begin? I had a vile evil credit union repo my car over a misunderstanding, they wouldn't work with me even when I offered full payment plus repo fees (this was my first repo!) so I didn't know what to do. I met with a few lawyers but when I met with Simon he broke things down and gave me my options. I needed a car - so I filed BK and included the car to get it back. The evil credit union fought and Simon GOT ME MY CAR BACK!!! His team is amazing!!!! Maria Donna etc!!! These are top-notch pros that'll have your back. I cannot recommend them highly enough. Sincerely they saved my life. LA with no car!? ARGH!!!!!! *THANX ALL!!!!- Tim C.

-

"Without the support of pro bono attorneys we couldn't do all the work we need to do, and your firm in particular is outstanding."

Thank you for your great work on behalf of Ms. Johnson. Without the support of pro bono attorneys we couldn't do all the work we need to do, and your firm in particular is outstanding.

- Skip K. -

"We are very happy that you were able to accomplish the modification of our loan in such a short period of time. Thank you again for your professional service."

Dear Mr. Resnik: We wanted to thank you for your professional handling of our loan modification with GMAC mortgage. We are very happy that you were able to accomplish the modification of our loan in such a short period of time. Thank you again for your professional service.

- W and B Mejia -

"They were thorough, extremely knowledgeable, wonderful to deal with, thoughtful, and really helped guide me through what was one of the toughest times in my life."Matt and his team are the best!! They were thorough, extremely knowledgeable, wonderful to deal with, thoughtful, and really helped guide me through what was one of the toughest times in my life. I never felt judged or looked down on. They were efficient and really were lifesavers during this tough time. I can not recommend them highly enough!!!!- Rusty H.

-

"He not only saved my house but also got rid of all my debt. They are not your typical attorneys and their creativity really allowed me to do things that other attorneys never mentioned in previous consults."Fantastic office! I want to thank Matt for taking his time with me and sincere in his assistance. He spent over an hour with me for free during our initial consult. I left knowing exactly what's needed. He not only saved my house but also got rid of all my debt. They are not your typical attorneys and their creativity really allowed me to do things that other attorneys never mentioned in previous consults. Affordable and Outstanding firm and thank you for all you have done! My family thanks you!- David K.

-

"Was very impressed with the comprehensive professionalism of the firm..."

Was very impressed with the comprehensive professionalism of the firm, especially Matthew Resnik... I had suffered through the incompetence of two previous bk lawyers not to mention fees far greater than anticipated, without resolution. Having never gone through bk before, I did not realize how difficult it could be...then, my case was turned over to Mr. Resnik...almost immediately there was a marked positive difference. Where there was little to no communication, all of a sudden I am getting updates...regularly. Further, my case was finally discharged...yet, Mr. Resnik continues to communicate, offer assistance...and, has NEVER asked for additional fees, which I am sure he could have justified...much unlike the two previous attorneys with which I was dealing. I have no reservations, whatsoever, referring and recommending Matthew Resnik for any and all business or personal bk issues...or, other wise. I have no doubt that he will be transparent on helping you regardless of the problem. Good guy.. good firm... a wonderful experience!

- G.L -

"He negotiated on my behalf with a credit card company and was able to settle with them for much lower than I could have on my own."I worked with David Kritzer at this firm, and he was great. He negotiated on my behalf with a credit card company and was able to settle with them for much lower than I could have on my own thanks to his knowledge and expertise in the field. If you have a debtor on your back go to him to get it taken care of.- Kelly S.

-

"As the dank blanket of economic uncertainty continues to depress the hopes of many of us, I keep your business cards and number available for others."This is to thank you for the exceptional work of you and your fine staff. In managing my bankruptcy and loan modification, a nearly five-year effort, your performance was stellar. I never felt alone or adrift, key concerns in those circumstances. The outcome was outstanding. As the dank blanket of economic uncertainty continues to depress the hopes of many of us, I keep your business cards and number available for others. Without hyperbole, I can attest that you are present a beacon. Thank you so much.- K.C.

-

"I filed bankruptcy with this firm 3 years ago and found that they are professional, friendly, and compassionate."I filed bankruptcy with this firm 3 years ago and found that they are professional, friendly, and compassionate. I also met with their loan modification department. Unfortunately, they were unable to help because of the type of loan that I have. I really appreciated that they did not lie, waste my time, or take my money in an attempt to modify a loan that was not doable. I've since used their firm for a couple of minor issues and found all of the attorneys to be knowledgeable and considerate. Attorneys Simon and Resnik are amazing!- Shannon J.

-

A Summary of Bankruptcy Law: Third Edition

A Summary of Bankruptcy Law: Third Edition -

Summary of Chapter 13

Summary of Chapter 13