Foreclosure Attorney in Los Angeles

Get Help from the Southern California Lawyers Known as the "Home Savers"

The threat of losing your home is frightening. If you are unable to keep up with your mortgage payments, you want to find a way to avoid home foreclosure. It is easy to feel helpless in a situation like this, but the right foreclosure attorney can help you save your home using a number of legal options, including Chapter 13 bankruptcy. At the law offices of RHM LAW LLP, we help people throughout the San Fernando Valley, Los Angeles, Riverside, San Bernardino, and Orange counties to avoid home foreclosure and get the debt relief they deserve. If you need to avoid home foreclosure and have decided to pursue bankruptcy as an option or home loan modification, we will help you save your home.

As the number one filer of home-saving Chapter 13 bankruptcy petitions in Los Angeles and the San Fernando Valley, we know how to help our clients through the entire process and assist them in staying in their homes. If you have decided that this is the option for you, you can feel confident with your decision in choosing the experience of RHM LAW LLP.

Call (213) 344-0043 or contact us online for a free consultation with our Los Angeles foreclosure defense attorney. It could be your first step out of the dark and into the light. You will feel better after speaking to us.

Understanding California Foreclosure Laws

California follows a non-judicial foreclosure process, which allows lenders to foreclose on a home without court intervention. This typically makes the process quicker and can leave homeowners with less time to prepare their defense. At RHM LAW LLP, we recognize the urgency of these situations and act swiftly to protect your rights and interests. We can help you understand the specific timelines and procedures involved in a California foreclosure, which can ultimately be the key to developing an effective defense or negotiation strategy.

One of the critical aspects of California's foreclosure laws is the existence of the 21-day Notice of Sale period as part of the foreclosure timeline. Understanding such details empowers you to take decisive action, as neglecting notification timelines can significantly impact your ability to challenge or delay the process. Additionally, knowing your rights under the California Homeowner Bill of Rights can be instrumental, as it prohibits some unfair practices in the foreclosure process. Our team provides you with the insights needed to navigate these laws effectively.

How a Foreclosure Lawyer in Los Angeles Can Help You

RHM LAW LLP

Meet Our Los Angeles Bankruptcy Specialists

-

M. Jonathan Hayes Senior Counsel

M. Jonathan Hayes Senior Counsel -

Matt D. Resnik | Partner Partner

Matt D. Resnik | Partner Partner -

Roksana D. Moradi-Brovia | Partner Partner

Roksana D. Moradi-Brovia | Partner Partner -

Russell J. Stong III | Associate Attorney Senior Associate Attorney, Los Angeles Office

Russell J. Stong III | Associate Attorney Senior Associate Attorney, Los Angeles Office -

W. Sloan Youkstetter | Associate Attorney Senior Associate Attorney, Los Angeles Office

W. Sloan Youkstetter | Associate Attorney Senior Associate Attorney, Los Angeles Office -

David M. Kritzer Senior Associate Attorney, Encino Office

David M. Kritzer Senior Associate Attorney, Encino Office

Client Reviews

What Clients Say About Working With Us

-

"I cannot thank them enough for helping save my home. I would recommend them for anyone that is thinking about filing for bankruptcy or foreclosure on their home."I needed a bankruptcy attorney in Sherman Oaks and found Matt Resnik on Google. He has one of the best-reviewed bankruptcy law firms on Yelp so I decided to check it out his law firm for myself. I quickly found out that they are foreclosure specialists and they could help me with my issue. They made the process very easy for me and laid out my options for me. I cannot thank them enough for helping save my home. I would recommend them for anyone that is thinking about filing for bankruptcy or foreclosure on their home. They are the best bankruptcy law firm in Sherman Oaks.- Joseph R.

-

"We are very happy that you were able to accomplish the modification of our loan in such a short period of time. Thank you again for your professional service."

Dear Mr. Resnik: We wanted to thank you for your professional handling of our loan modification with GMAC mortgage. We are very happy that you were able to accomplish the modification of our loan in such a short period of time. Thank you again for your professional service.

- W and B Mejia -

"They were thorough, extremely knowledgeable, wonderful to deal with, thoughtful, and really helped guide me through what was one of the toughest times in my life."Matt and his team are the best!! They were thorough, extremely knowledgeable, wonderful to deal with, thoughtful, and really helped guide me through what was one of the toughest times in my life. I never felt judged or looked down on. They were efficient and really were lifesavers during this tough time. I can not recommend them highly enough!!!!- Rusty H.

-

"As the dank blanket of economic uncertainty continues to depress the hopes of many of us, I keep your business cards and number available for others."This is to thank you for the exceptional work of you and your fine staff. In managing my bankruptcy and loan modification, a nearly five-year effort, your performance was stellar. I never felt alone or adrift, key concerns in those circumstances. The outcome was outstanding. As the dank blanket of economic uncertainty continues to depress the hopes of many of us, I keep your business cards and number available for others. Without hyperbole, I can attest that you are present a beacon. Thank you so much.- K.C.

-

"He negotiated on my behalf with a credit card company and was able to settle with them for much lower than I could have on my own."I worked with David Kritzer at this firm, and he was great. He negotiated on my behalf with a credit card company and was able to settle with them for much lower than I could have on my own thanks to his knowledge and expertise in the field. If you have a debtor on your back go to him to get it taken care of.- Kelly S.

-

"Was very impressed with the comprehensive professionalism of the firm..."

Was very impressed with the comprehensive professionalism of the firm, especially Matthew Resnik... I had suffered through the incompetence of two previous bk lawyers not to mention fees far greater than anticipated, without resolution. Having never gone through bk before, I did not realize how difficult it could be...then, my case was turned over to Mr. Resnik...almost immediately there was a marked positive difference. Where there was little to no communication, all of a sudden I am getting updates...regularly. Further, my case was finally discharged...yet, Mr. Resnik continues to communicate, offer assistance...and, has NEVER asked for additional fees, which I am sure he could have justified...much unlike the two previous attorneys with which I was dealing. I have no reservations, whatsoever, referring and recommending Matthew Resnik for any and all business or personal bk issues...or, other wise. I have no doubt that he will be transparent on helping you regardless of the problem. Good guy.. good firm... a wonderful experience!

- G.L -

"Matt and his staff conducted themselves with professionalism throughout the whole ordeal."I worked with Matt and his team for about a year to get through the paperwork shuffle and my personal experience was nothing short of fantastic. Legal situations have a tendency to get hairy, but Matt and his staff conducted themselves with professionalism throughout the whole ordeal. To keep it short, let's just say he under-promised and over-delivered. Rarely would I ever say this about an attorney, but overall he was just a great guy. I would not hesitate to have him on my side of the courtroom again. World market is right across the street from his office and I even decided to get his staff a thank you / holiday gift card. World market has excellent craft beer BTW, try the Einstock White Ale. They also validate parking. That just shows this isn't a fake review.- Dean C.

-

"Without the support of pro bono attorneys we couldn't do all the work we need to do, and your firm in particular is outstanding."

Thank you for your great work on behalf of Ms. Johnson. Without the support of pro bono attorneys we couldn't do all the work we need to do, and your firm in particular is outstanding.

- Skip K. -

"He not only saved my house but also got rid of all my debt. They are not your typical attorneys and their creativity really allowed me to do things that other attorneys never mentioned in previous consults."Fantastic office! I want to thank Matt for taking his time with me and sincere in his assistance. He spent over an hour with me for free during our initial consult. I left knowing exactly what's needed. He not only saved my house but also got rid of all my debt. They are not your typical attorneys and their creativity really allowed me to do things that other attorneys never mentioned in previous consults. Affordable and Outstanding firm and thank you for all you have done! My family thanks you!- David K.

-

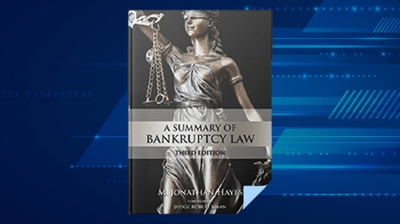

A Summary of Bankruptcy Law: Third Edition

A Summary of Bankruptcy Law: Third Edition -

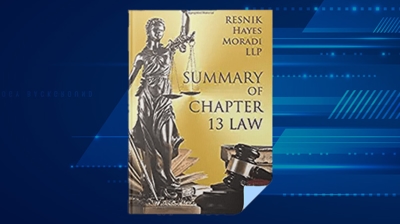

Summary of Chapter 13

Summary of Chapter 13